3 Easy Facts About Frost Pllc Shown

3 Easy Facts About Frost Pllc Shown

Blog Article

The 2-Minute Rule for Frost Pllc

Table of ContentsThe Buzz on Frost PllcNot known Details About Frost Pllc The Facts About Frost Pllc RevealedFrost Pllc Things To Know Before You BuyOur Frost Pllc Statements

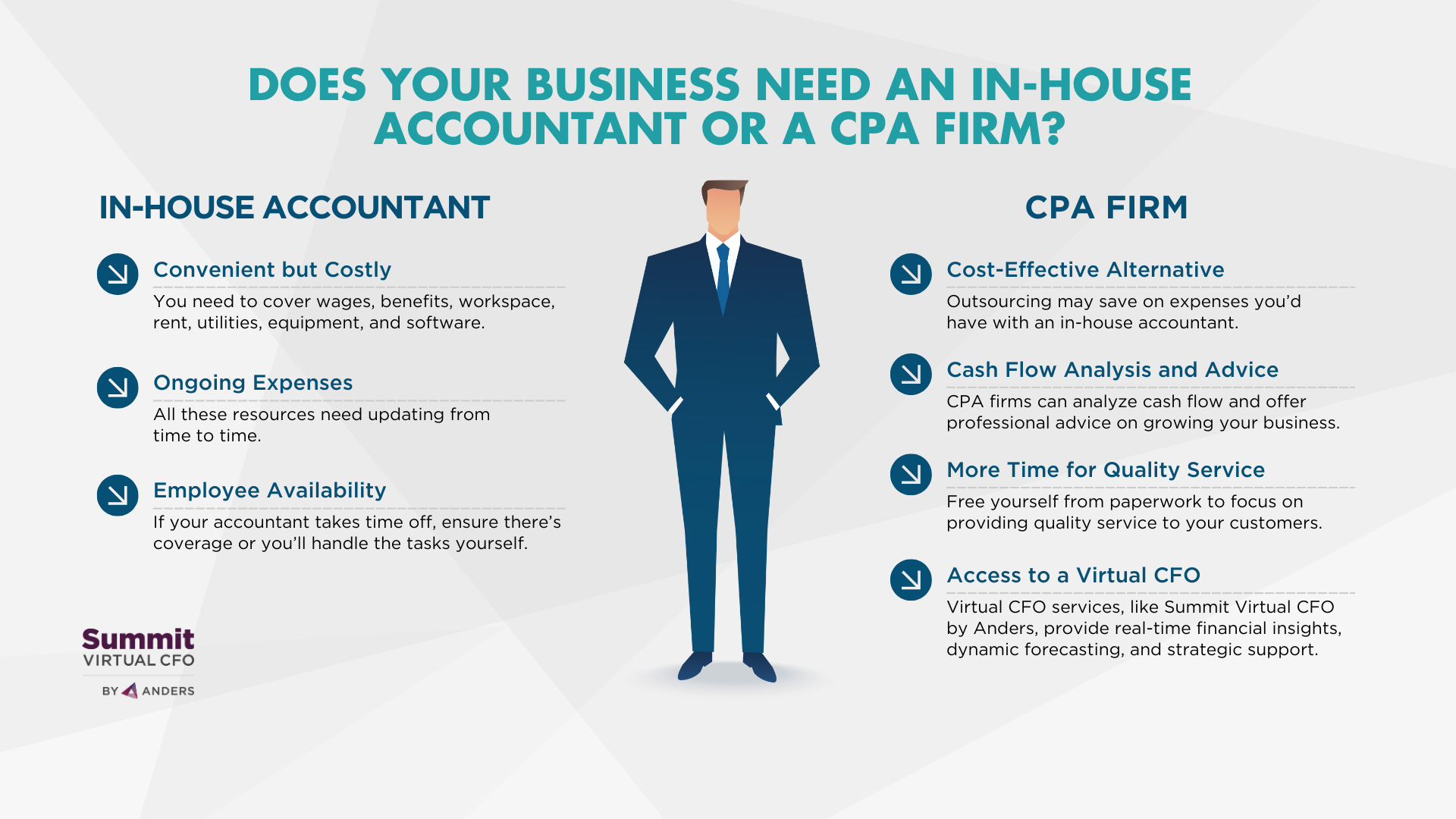

Certified public accountants are among one of the most trusted occupations, and for excellent reason. Not only do Certified public accountants bring an unequaled degree of knowledge, experience and education and learning to the process of tax obligation planning and handling your cash, they are especially educated to be independent and objective in their job. A certified public accountant will assist you protect your rate of interests, listen to and resolve your concerns and, just as crucial, give you satisfaction.Working with a local Certified public accountant firm can positively impact your company's economic wellness and success. A regional CPA firm can assist lower your company's tax problem while ensuring compliance with all applicable tax obligation legislations.

This growth shows our devotion to making a positive influence in the lives of our customers. When you work with CMP, you end up being component of our household.

8 Simple Techniques For Frost Pllc

Jenifer Ogzewalla I have actually worked with CMP for a number of years currently, and I have actually truly valued their proficiency and efficiency. When auditing, they work around my schedule, and do all they can to preserve connection of personnel on our audit.

Below are some vital inquiries to guide your decision: Inspect if the certified public accountant holds an energetic license. This guarantees that they have passed the needed tests and fulfill high ethical and expert standards, and it shows that they have the credentials to handle your economic issues properly. Confirm if the certified public accountant offers services that line up with your company needs.

Local business have unique monetary demands, and a CPA with pertinent experience can provide more tailored advice. Inquire about their experience in your market or with organizations of your dimension to guarantee they understand your particular challenges. Understand how they bill for their services. Whether it's hourly, flat-rate, or project-based, knowing this upfront will avoid shocks and confirm that their services fit within your budget.

Employing a neighborhood Certified public accountant firm is even check these guys out more than simply contracting out economic tasksit's a clever investment in your service's future. Certified public accountants are certified, accounting specialists. CPAs may function for themselves or as part of a firm, depending on the setup.

Examine This Report about Frost Pllc

Taking on this obligation can be a frustrating task, and doing something wrong can cost you both financially and reputationally (Frost PLLC). Full-service CPA firms recognize with declaring requirements to guarantee your organization follow government and state laws, as well as those of banks, investors, and others. You may need to report additional income, which might require you to file an income tax return for the very first time

team you can trust. Get in touch with us to learn more concerning our solutions. Do you understand the accountancy cycle and the actions included in making certain proper economic oversight of your service's monetary health? What is your business 's lawful framework? Sole proprietorships, C-corps, S corporations and partnerships are exhausted differently. The even more facility your revenue resources, places(interstate or international versus regional )and sector, the extra you'll need a CERTIFIED PUBLIC ACCOUNTANT. CPAs have more education and go through an extensive qualification procedure, so they set you back more than a tax obligation preparer or bookkeeper. Typically, little businesses pay in between$1,000 and $1,500 to work with a CERTIFIED PUBLIC ACCOUNTANT. When margins are tight, this cost might beunreachable. The months prior to tax day, April 15, are the busiest season for CPAs, followed by the months prior to completion of the year. You may have to wait to get your inquiries addressed, and your tax return might take longer to finish. There is a limited variety of Certified public accountants to walk around, so you may have a tough time discovering one particularly if you've waited up until the eleventh hour.

Certified public accountants are the" large guns "of the bookkeeping sector and normally do not take care of everyday accounting jobs. Often, these other types of accountants have specialties across locations where having a CPA certificate isn't required, such as monitoring accounting, nonprofit accountancy, expense bookkeeping, federal government accounting, or audit. As a result, using a bookkeeping services business is typically a far better worth than employing a CPA

firm to support your sustain financial continuous monetaryAdministration

CPAs likewise have competence in establishing and perfecting business plans and procedures and analysis of the practical needs of staffing versions. A well-connected CPA can utilize their network to assist the organization in various strategic and getting in touch with roles, efficiently attaching the organization to the optimal prospect to accomplish their needs. Following time you're looking to fill a board seat, take into consideration getting to out to a CPA that can bring value to your organization in all the ways provided above.

Report this page